Usually, Every Muslim who is wealthy they are thinking about how to calculate Zakat on gold in Pakistani rupees. This page is giving the best method in English and Urdu Language. Usually, every year in Ramzan Month Zakat calculation is a very major question by Pakistan Muslims. On Different TV Channel Zakat calculate details are giving in Ramzan month if you miss it then read this page details and idea about Zakat calculation. If you are Sahib e Nisaab Muslim then under the Quran instruction you will eligible to pay Zakat. Readers Sahib e Nissaab person definition is a person who has 87.27 grams gold or 610.9 grams of silver they will pay Zakat.

Table of Contents

If a person does not have silver or gold then equal level wealth will count for Zakat. In further detail, we will explain the procedure to calculate Zakat on gold in Pakistani rupees and which things are not including in Zakat. The Gold rate is getting increased day by day and that is why the correspondingly the rate of Zakat on Gold in Pakistan is also correspondingly higher which you have to calculate on the same when you are going to pay the amount. One can pay the amount or can also donate the grocery items to needy persons. You can also obtain these details below on this page which you have to read on this page below.

How To Calculate Zakat On Gold In Pakistani Rupees

Here we are sharing the details about how to calculate zakat on gold in Pakistani rupees. We are sharing the details about the amount of Zakat and the weight of the gold you have. Remember that there is a speical amount which you or your wife if owing or in case you are a gold smith you must be aware about some islamic and sharai restrictions applicable on a specific amount of gold.

What To Check Before Finalizing Your Zakat Against Gold:

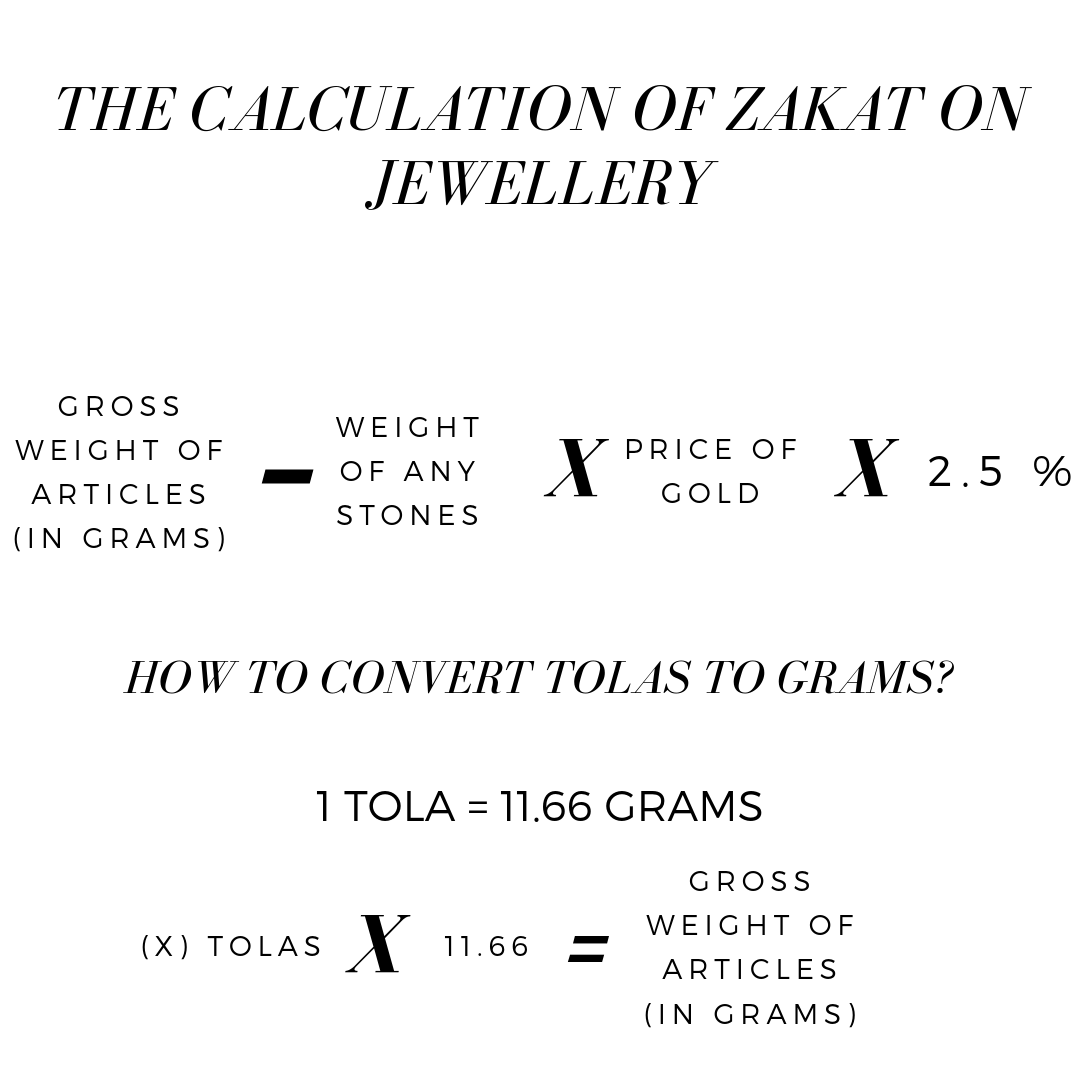

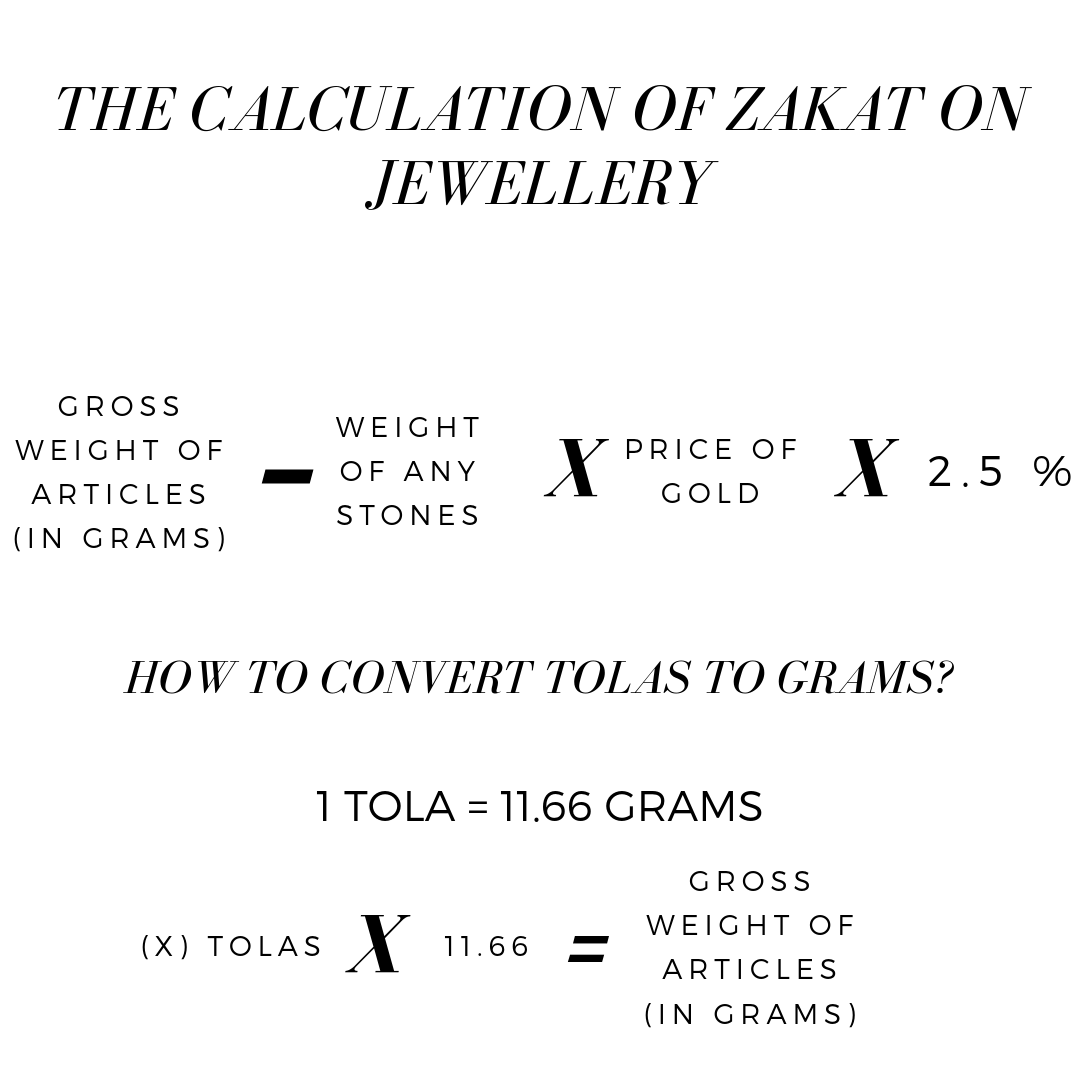

It is additionally reasonable to pay Zakat in real money. This is finished by giving the market estimation of 2.5% of the heaviness of the adornments in Zakat. For instance, on the off chance that somebody has gold adornments that gauge 10 grams, they should give the market estimation of 0.25 grams (for example 2.5% of 10 grams) of gold as Zakat. Subsequently, if the market estimation of gold is £38* per gram (*as of 24th March 2024), they should pay £9.50 (0.25 x 38) as Zakat.

- Zakat Calculate formula on Gold to Pakistan Rupees

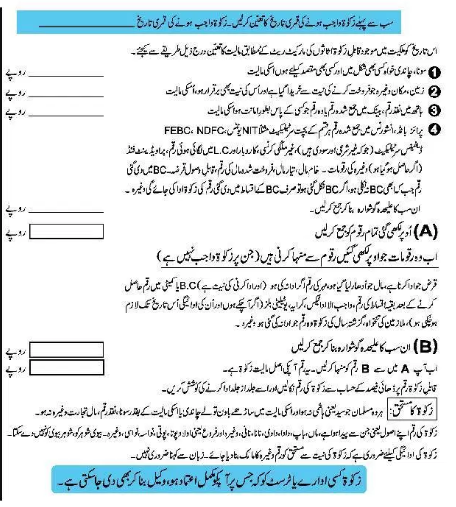

- Decide Date when Zakat will apply on your its must Qamri Date

- Calculate Gold, Silver

- Calculate Land, House, etc those who are purchasing for selling objective

- Calculate cash in hand

- Calculate amount that given by your for Amanat objective

- Calculate price bond, Insurance currency, Saving certificate NIT Units, NDFC, FEBC, Defence Certificate, Foreign currency, BC

- now calculate Loan amount

- now Add B.C that is not pay

- Add Tax amount

- Rent

- Utility Bills

- Employees Salaries

- Previous year Zakat amount that is still not pay

How To Calculate Zakat On Gold In Pakistani Rupees:

Zakat farz on Muslim those who are sahib e Hisaab. Now we are sharing How To Calculate Zakat On Gold In Pakistani Rupees in Urdu. This Urdu picture is copied by our website. Islamic knowledge is very important to share with your friends and family members.